- Products

- Learn & Plan

- Customer Support

- Careers

- Get a Term Quote

April 13, 2020 // All //

As you reach critical milestones in your life, you may find yourself looking for ways to protect what you’ve built. Life insurance offers that protection in the form of financial coverage for your loved ones if you pass away.

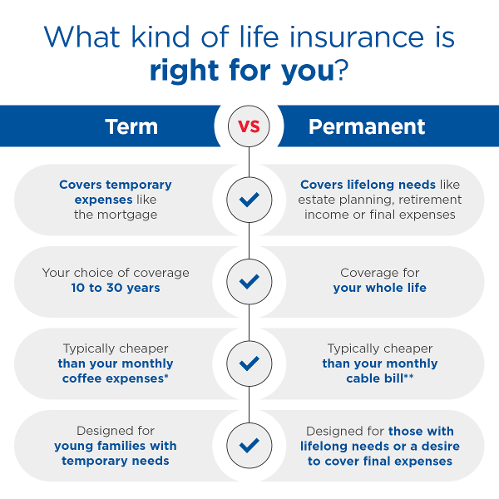

But which type of life insurance is best for you? Many people don’t know there are different coverage options to begin with or where to start. That’s where we come in. Below, we break down the two most common types of life insurance, Term and Permanent, and the differences between each. Whether you just bought a house, got married, started a family or recently retired, there’s a type of life insurance to fit your ever-changing coverage needs.

Term

Term life insurance is generally designed for young families to take care of specific, immediate needs like a mortgage, educational expenses, automotive loans or anything else you might need to cover for your loved ones.

Permanent

Permanent life insurance is typically designed for those with lifelong needs, which may include estate planning, retirement income and all of your final expenses (like funeral and burial costs).

Term

Covers you for a specific period of time, also known as a term. Often, terms are available in 10, 15, 20, 25, and 30-year lengths, and you can choose the length of coverage that’s right for you.

Permanent

As long as premiums are paid on time, permanent coverage is designed to last a lifetime.

Term

Term tends to be less expensive because your coverage lasts for a specific time period. It’s typically cheaper than what the average person spends on coffee per month.* Term insurance is known for its low premiums and guaranteed payouts. Your beneficiaries will get a tax-free lump sum of money if you pass away while you have this coverage.

Permanent

Permanent life insurance is typically cheaper than what the average person spends on cable per month.** Many permanent life insurance policies also accumulate cash value over time. Each month, your premium payment goes towards your life insurance coverage and an investment element. You may borrow or withdraw that money from the investment side for whatever needs may come your way. Keep in mind that any withdrawals could reduce the death benefit if they aren’t paid back.

Yes. Many people “convert” their term coverage to a permanent policy. This conversion privilege, which is available in many term policies, may offer those who cannot initially afford permanent insurance an opportunity to switch at a later date. Discover why it may be beneficial to convert your life insurance policy.

When you convert a Term policy to a Permanent policy, it typically eliminates the need to undergo a new medical examination or provide updated financial information – as long as there are no increases in the coverage amount or any additional riders. There may be other restrictions and limitations, so please contact a AAA agent to discuss your options.

Yes. Many people use a combination of these two types of life insurance to cover temporary and permanent needs.

Regardless of which type of insurance you choose, you have so many reasons to take the necessary steps to keep you and your family covered. No one plans to pass away, but when it happens, it’s reassuring to know that their college tuition, the household bills, your final expenses, and other costs today and 30 years down the road could be taken care of.

Contact an agent to get your free quote.

Not ready to speak with an agent? Start a quote online and review your options.

[SOURCES]

* “Americans Pay an Average $2.70 for Coffee, While Tipping 20 Percent,” Tom Risen, U.S. News, September 29, 2015.

** “Why the Price of Cable TV Stopped Going Up So Fast This Year” Aaron Pressman, Fortune, November 15, 2018. http://fortune.com/2018/11/15/average-cable-tv-bill-cord-cutting/

ALAN-21120-419-XX

Unfortunately, many of us don’t put something much more important in the “must have” column of our budget: life insurance.

Read More

The journey toward added peace of mind starts now.

Read More