- Products

- Learn & Plan

- Customer Support

- Careers

- Get a Term Quote

Traditional TERM LIFE Insurance

Finding a Term Life Insurance policy that can help cover your needs while remaining affordable doesn’t have to be a challenge. With a Traditional Term Life Insurance policy from AAA Life, you’ll find that obtaining affordable coverage could be easier than you think. AAA Life’s Traditional Term life insurance allows you to choose 10- to 30-year terms with coverage ranging from $50,000 - $5,000,000+. Insurance premiums are locked-in and never increase during the initial term, which means that your coverage can remain affordable.

Riders add special benefits to further customize a policy for an additional cost.

Add up to $20,000 of life insurance protection per eligible child

Allows you to stop paying your premiums if you are totally disabled, without losing your policy

Get all of your premium payments back if you outlive your term length. Click here for details

AAA Life’s Traditional Term Life Insurance isn’t just designed for one person – it’s designed to help protect your future and the future of those most important to you. With many customizable features and the ability to add riders —including life insurance for children or Term with Return of Premium (ROP) —AAA Life’s Traditional Term Life Insurance offers the flexibility needed when you have a lot to protect.

AAA Life is dedicated to providing educational resources about Traditional Term Life Insurance policies and the other excellent insurance packages we offer. We’ve provided informational articles and educational tools to help you learn more about life insurance and how you can help protect those who matter most — even after you’re gone.

Term Life Insurance Articles

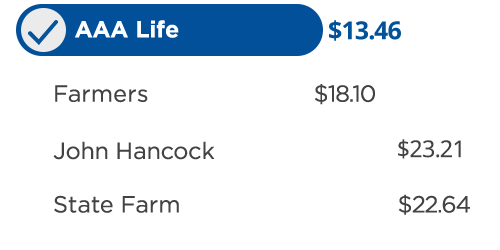

Monthly automatic premium for 10-year level term policy, female, age 35, best class non-nicotine.

Comparison of publicly available rates from Compulife and company websites. Rates were not furnished by these companies and you may contact them with any questions. Rates shown are current as of 1/17/2024 and are subject to change.

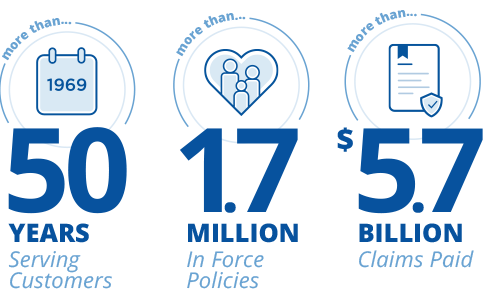

We take pride in offering quality service to our

many customers—and it shows! There’s strength

in our number of customers, claims paid, and

especially our competitive premium rates.