- Products

- Learn & Plan

- Customer Support

- About Us

- Get a Term Quote

February 17, 2020 // All resources---tips // personal-finance

Living life can be expensive. We all have bills to pay and expenses like food for our families and transportation to get us to and from work. We also have costs we don’t always think about, like taking care of pets and celebrating special events.

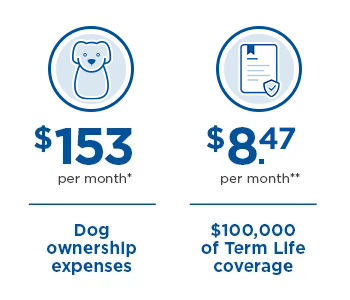

These “life costs” add up – and we might not even realize how much we’re spending. For example, dog owners spend an average of $153* a month to take care of their pet. The costs of more urgent living necessities are even higher. Did you know the average household spends about $584 on food per month1?

How would your family cover these expenses if you’re no longer there?

Life insurance is a practical way to cover these expenses in the event something happens to. But is life insurance out of reach based on your budget? Many people think so. In fact, most Americans overestimate the cost of life insurance by three times.2

In reality, life insurance can be a surprisingly affordable way to help protect your family. In fact, depending on your health and other factors, it can cost less per month than your daily expenses for food.

Life insurance can be a valuable part of your family’s financial security and overlooking this important coverage could leave those you care about the most without the future they deserve.

Consider working life insurance into your budget as another essential to help protect those most important to you. Get your life insurance quote today, or contact your local AAA Life Insurance Specialist at AAA.com/Agent.

*rover.com – The True Cost of Getting a Dog – July 2018

**Monthly automatic premium for 10-year level term policy, female, AAA member, age 35, best class non-nicotine

1Bureau of Labor Statistics, Consumer Expenditures - 2015. Aug 30, 2016

2Life Happens, LIMRA – 2019 Insurance Barometer Report

ALAN-24145-220-XX

In difficult circumstances, you want to work with a company that puts your family first. AAA Life can be there when you need it most.

Read More

Avoid misconceptions standing in the way of you getting—or keeping—the right coverage.

Read More

If you’re hesitating about getting life insurance—here are eight reasons to do it today.

Read More