- Products

- Learn & Plan

- Customer Support

- Careers

- Get a Term Quote

Term with Return of PREMIUM Life Insurance

Life insurance is designed to help protect the financial future of those you care about, but that protection could also help benefit you in the long run. While there are many excellent Term Life Insurance policies available, Term with Return of Premium from AAA Life ensures you’ll receive 100% of your premiums back at the end of the term period if coverage is never used. This means you’ll have the chance to help pay for retirement, college for the kids, to help pay off or reduce your mortgage, or invest further in your future – it’s your money.

AAA Life’s Term with Return of Premium gives back 100% of your payments if you outlive the initial term period. Available for 15, 20, or 30-year coverage periods, just keep your policy and ROP benefit in effect by paying your premiums when due.

It’s our goal to provide you with the best life insurance coverage available, at a price you can afford. And with Traditional Term with Return of Premium, you get the added benefit of getting your payments back if you don’t use your policy—because buying life insurance should help provide you with financial peace of mind, not a financial burden.

AAA Life is dedicated to providing educational resources about Term Life Insurance policies and the other excellent insurance packages we offer. We’ve provided informational articles and educational tools to help you learn more about life insurance and how you can protect those who matter most — even after you’re gone.

Term Life Insurance Articles

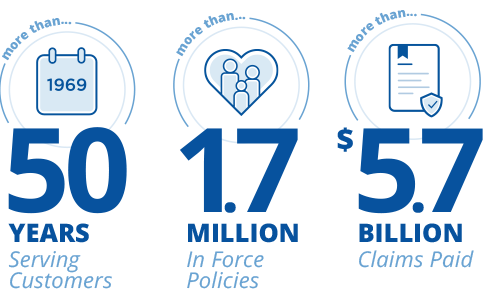

We take pride in offering quality service to our

many customers—and it shows! There’s strength

in our number of customers, claims paid, and

especially our competitive premium rates.