- Products

- Learn & Plan

- Customer Support

- About Us

- Get a Term Quote

Guaranteed Issue WHOLE LIFE Insurance

Your beneficiaries will receive the total benefit amount from day one for accidental death. This Guaranteed Issue Whole Life policy is referred to as graded benefit whole life insurance. If you suffer a non-accidental death within the first two years of coverage, your beneficiaries will get 100% of the level monthly premiums you paid, plus 30%. If death occurs after two years, then the total amount of your coverage is paid, no matter what the cause of death

According to the National Safety Council's 2016 Injury Facts®, travel accidents are a leading cause of death from unintentional injuries. With Guaranteed Issue Whole Life Insurance, if you die in a covered travel accident, the death benefit doubles. It's automatic, and there are no additional premiums. With this travel accident benefit a $20,000 benefits becomes $40,000; or $15,000 becomes $30,000 and so on. (See policy for details.)

With Guaranteed Issue Whole Life, not only can you get the life insurance benefits you’re looking for, you’ll get to utilize AAA Life Insurance Company’s quick-and-easy guaranteed acceptance process.

You've made a great choice in helping protect the financial future of those you care about most. Take a moment to read through the educational resources we’ve provided below, and be sure to contact your local AAA Life insurance agent for more information.

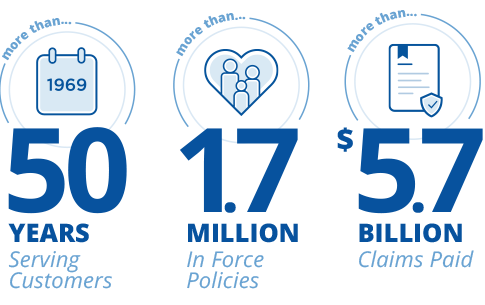

We take pride in offering quality service to our

many customers—and it shows! There’s strength

in our number of customers, claims paid, and

especially our competitive premium rates.

Not sure where to go from here? We've compiled a number of resources to help you.

Got a question? Need a policy?

Let’s connect you with someone

who can help.

Fact Sheet

Want to read about this product on the go? Take it with you!

Download the fact sheet.